As K-beauty continues to gain global attention, South Korea’s skincare industry is entering a new phase of innovation. Riding the success of popular skin boosters like the third-generation “Lijuran Healer,” the market is now watching closely for the next big breakthrough. One strong contender is GFC Life Sciences, a company pioneering fourth-generation skin boosters using plant-derived exosome technology.

GFC Life Sciences is preparing to transfer its listing from KONEX to KOSDAQ, backed by growing recognition of its proprietary biotechnology. In a recent interview with Maeil Economy, CEO Kang Hee-chul shared the company’s bold vision: “We aim to lead the K-beauty skin booster market by combining plant-based exosomes with skin microbiome research.”

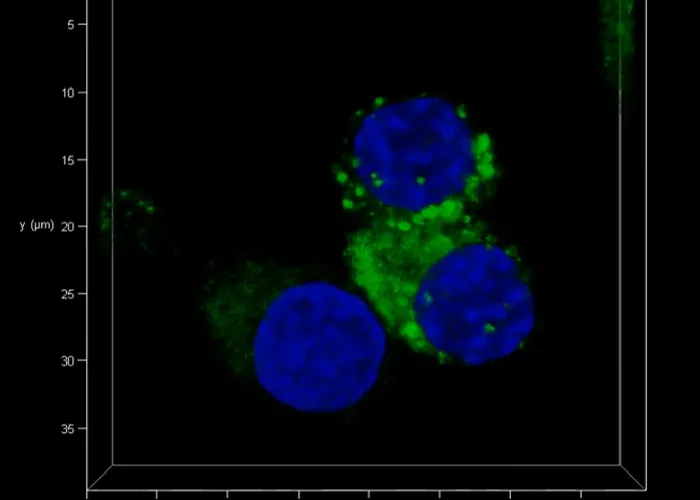

Exosomes are small vesicles that transport biological information like RNA and proteins between cells. In skincare, they are believed to stimulate cell signaling, accelerate skin regeneration, and support the skin’s natural healing process.

According to Kang, the global exosome market is projected to grow at an average annual rate of 24.8%, and GFC Life Sciences already holds key capabilities in exosome production, isolation, and validation. The company plans to launch a next-generation skin booster with self-produced exosomes as its main ingredient.

GFC is not new to the field—it already supplies a range of biotech and cosmetic materials to hospitals, clinics, and global beauty brands. In 2023, the company recorded ₩16.8 billion in revenue and ₩1.7 billion in operating profit. CEO Kang expects those numbers to rise by 36.8% and 184.8%, respectively, in 2024.

Looking ahead, GFC plans to expand beyond cosmetics into medical, pharmaceutical, and biotech fields, using plant-based exosomes and miRNAs as core assets. “We’re building a global biomaterials company,” Kang said.

To support this growth, GFC Life Sciences will raise between ₩9.6 billion and ₩12 billion through an upcoming public offering. Funds will be allocated as follows:

- 50% for factory expansion

- 20% for debt repayment

- 30% for R&D

The proposed offering price ranges from ₩12,300 to ₩15,300. Institutional investor demand forecasting will take place from May 30 to June 9, with public subscriptions open on June 12 and 13. The company is expected to debut on the KOSDAQ on June 20, with Daishin Securities managing the listing.

Related topics: